The blockchain enables the efficient sending of “value” (e.g. a sum of currency) anywhere in the world in a matter of seconds. With the invention of blockchain, value can now be transferred directly from one person to another (peer to peer) without the need for an intermediary party e.g. a financial institution. The blockchain addressed and solved the fundamental historical problem with person-to-person value transfer transactions. This problem is called “the double spend problem” and is outlined below.

The Double Spend Problem

When sending information you can actually only send a copy of the information (via the World Wide Web) and you can send that information as many times as you like, e.g. if the recipient didn’t receive your first email, you can send the email again.

However, with value, you can only ever send “value” once. If Lauren sends $1 to George, and George says he didn't receive it, Lauren can't resend the dollar as she no longer has it. It is lost. Value can only ever be sent once. If it was sent twice, in the above example, Lauren would have sent $2 and there would be a double spend.

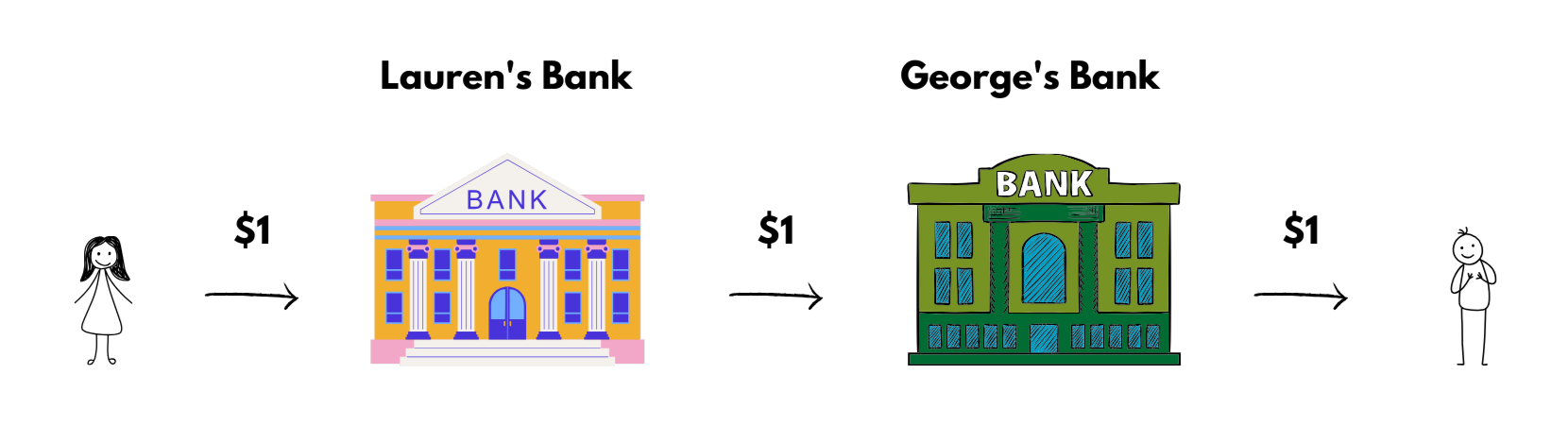

To solve the double spend problem financial intermediaries (i.e. banks) were required to stand between the two parties, with the bank being a ‘trusted intermediary’ of both parties. In the above example, Lauren trusts her bank, Lauren’s bank trusts George’s bank and George trusts his bank.

Lauren entrusts her bank to take $1 from her bank account and pay it to George’s bank, which then credits $1 to George’s account.

The example above is transfer of “money” value using the current financial bank-based system.

Value transfers happen everywhere and form the basis of human financial interaction and civilization advancement. Examples include money transactions, commodities transfers, equity transfers, money market transfers, bond transfers, asset transfers, asset registers, and property registers. All these markets have something in common, in that there is a register that is held by a centralised ‘trusted’ intermediary recording every transfer of value that is made.

The blockchain technology is a technology that allows for the transfer of value without the need for that centralised intermediary.

The Blockchain Technology

The blockchain technology enables “smart contracts”. Smart contracts are self-executing contracts with terms and conditions directly written into code on the blockchain. They automate and enforce agreements without the need for intermediaries. Smart contracts enable the transaction between two parties to take place without the need for a third party to be involved, thus making the transaction peer to peer. Smart contracts mean you don’t need a witness or entity (e.g. a bank) to authorise the transaction.

If Lauren wishes to send George one bitcoin, the network would first check to see if Lauren had one bitcoin in the bitcoin ledger. If Lauren did not have one full bitcoin, the transaction would not progress. If Lauren did have one full bitcoin it would be transferred to George. In the above example, the blockchain is completing the task a bank would, but more directly.

For the everyday bitcoin user - what matters is that the technology functions effectively, without requiring understanding of the intricacies of its operation. This parallels our reliance on the World Wide Web or a contemporary electric vehicle – we simply trust that the internet and our cars will perform their respective functions reliably.

Congratulations, you have completed Module 1, Lesson 2